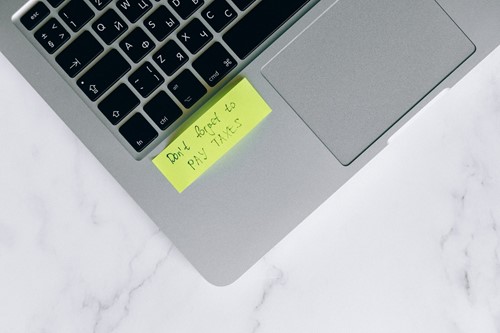

Like most recurring expenses, property taxes have late fees if not paid on time. While the amount and specific consequences vary from one municipality to the next, property tax late fees are something homeowners will want to avoid. Here are some basic facts about paying your property taxes on-time and in the correct amount:

Property taxes are calculated based on many factors. However, you can estimate them for yourself by multiplying the assessed value of the home by the local tax rate. The number you come up with is likely not the exact amount you'll see on your bill, but it's a great way to familiarize yourself with the general amount.

Luckily, most property tax payments get wrapped into your monthly mortgage payments. Otherwise, you have the choice of paying the taxes directly on an annual or semi-annual basis. Depending on your tax authority, this may mean writing and mailing a check or paying through an online portal.

There are some exemptions for property taxes. Some of the most common exemption types are available to seniors, people with disabilities, veterans and homesteaders. These exemptions usually don't eliminate taxes completely, but can significantly reduce the cost.

If you fail to pay your taxes, you'll get a tax lien placed on your home. Liens can adversely affect your credit score, and if taxes are left unpaid for too long, they can become levies allowing the government to seize your property. It's important to stay up to date on your property taxes and reach out to a professional if you expect any issues paying on time.